Income Tax In Malaysia For Foreigners 2020

Income tax deadline extended until 30 june 2020.

Income tax in malaysia for foreigners 2020. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. Personal income tax rates. If taxable you are required to fill in m form. Green technology educational services healthcare.

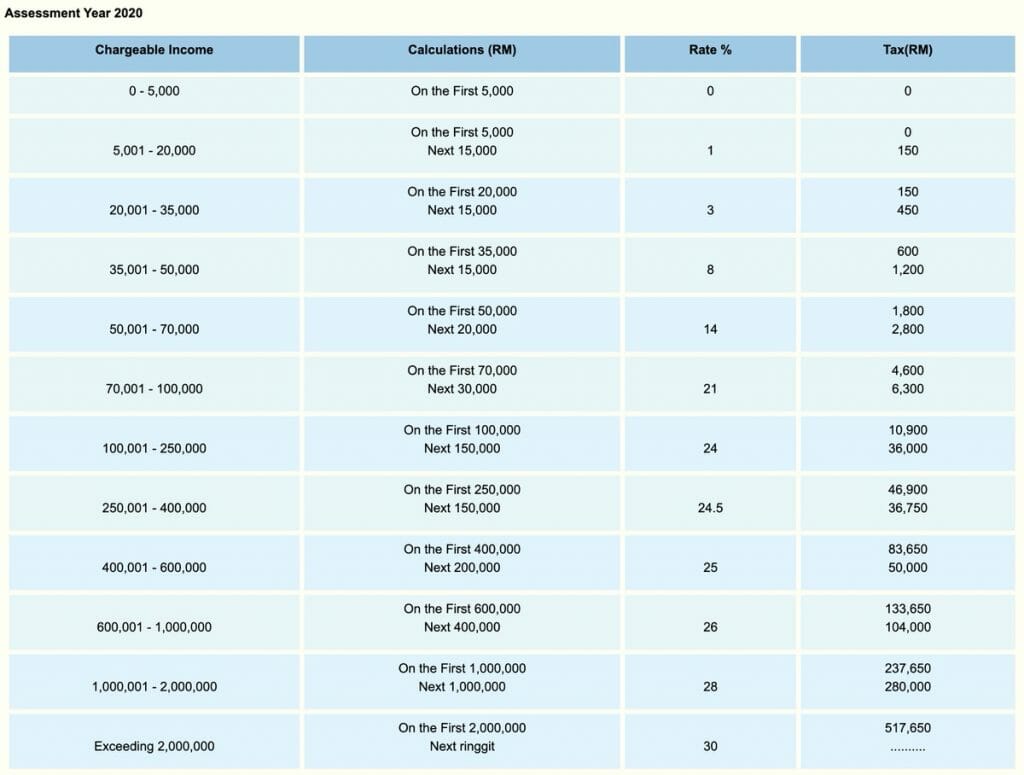

Individual income tax in malaysia for expatriates. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. Tax year the tax year is the calendar year. Foreigners with the non resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income.

For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Expatriates working in malaysia for more than 60 days but less than 182 days are considered non tax residents and are subject to a tax rate of 30 percent. Foreign tax relief foreign tax paid may be credited against malaysian tax on the same income limited to 50 of foreign tax in the absence of a tax treaty but the credit is limited to the amount of malaysian tax payable on the foreign income. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income.

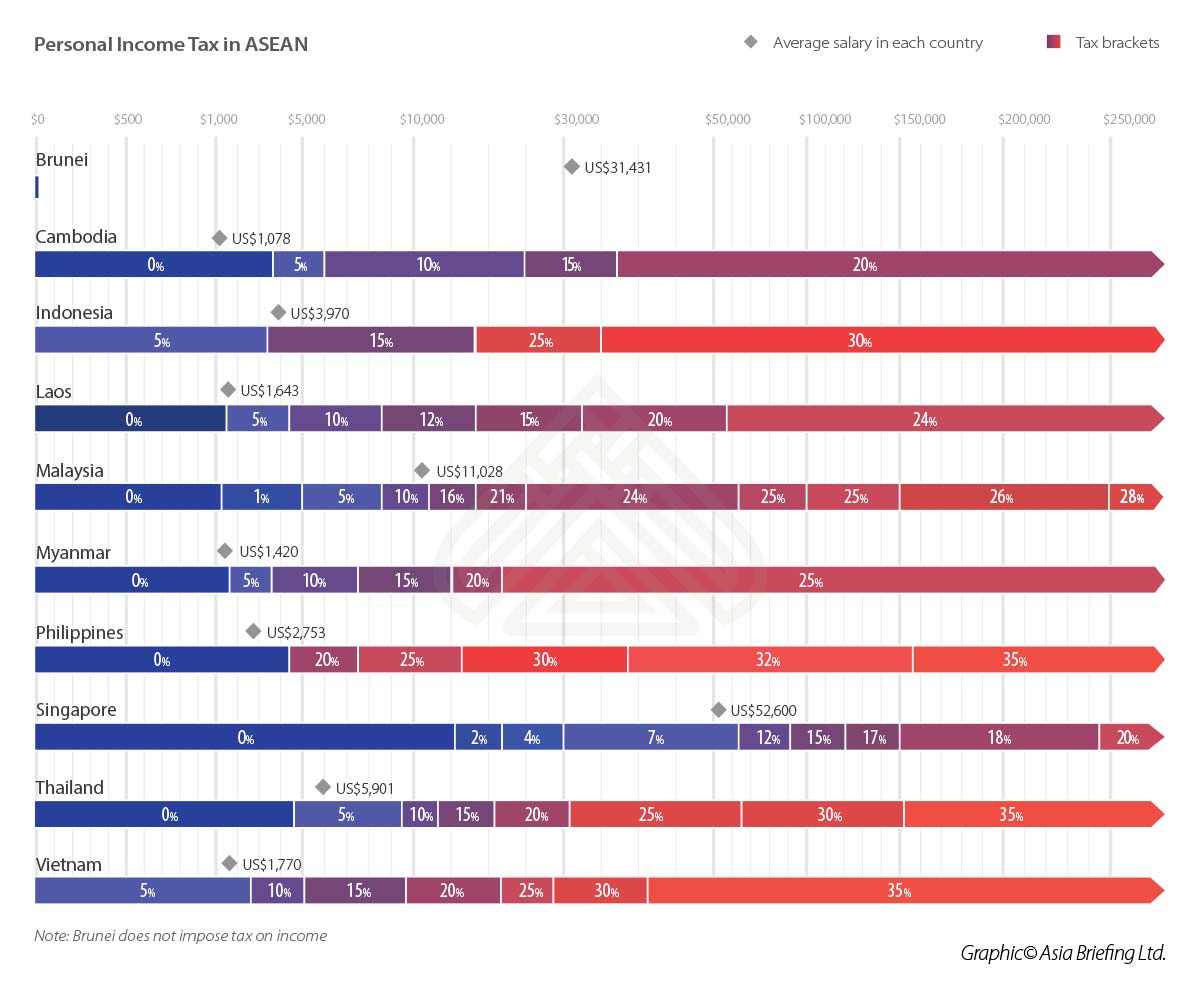

As a general rule anyone earning a salary in malaysia is required to pay income tax unless they fall into one of the exceptions. The following rates are applicable to resident individual taxpayers for ya 2020. Malaysia adopts a territorial principle of taxation meaning only incomes which are earned in malaysia are taxable. January 10 2020 posted by asean briefing written by ellena brunetti and bradley dunseith reading time.