Income Tax Return Malaysia

Income tax return form itrf every individual in malaysia including resident or non resident who is liable to tax is required to declare his income to inland revenue board of malaysia irbm or lembaga hasil dalam negeri malaysia ldhn.

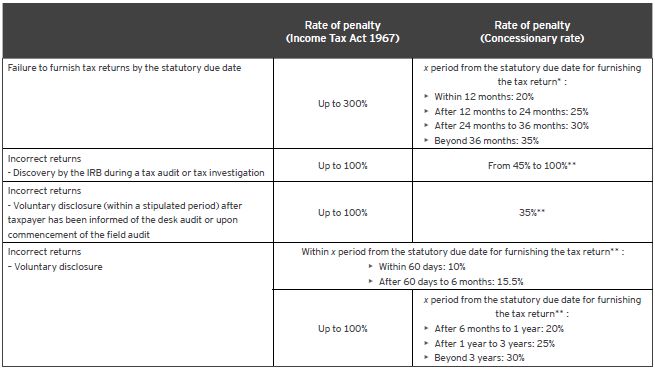

Income tax return malaysia. Malaysia various tax deadlines extended due to covid 19 malaysia various tax deadlines extended due the malaysian inland revenue board mirb has set out a new timetable for certain personal tax filing and employer compliance obligations including due date extensions in light of the covid 19 crisis. Taxpayer is responsible to submit income tax return form itrf and make income tax payment yearly prior to due date. The following rates are applicable to resident individual taxpayers for ya 2020. Type of income tax return form itrf for individual.

The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. Visit your nearest irb branch if you need help to complete your income tax return form or call the hasil care line at the hotline 03 89111000 603 89111100 overseas. On the first 5 000 next 15 000. Calculations rm rate tax rm 0 5 000.

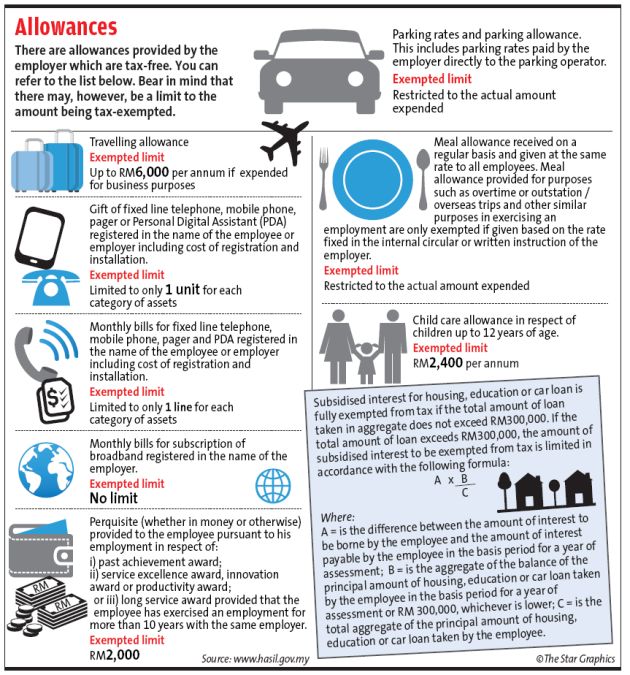

This method of e filing is becoming popular among taxpayers for its simplicity and user friendliness. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

204 tarikh kemaskini. Green technology educational services healthcare. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Personal income tax rates.

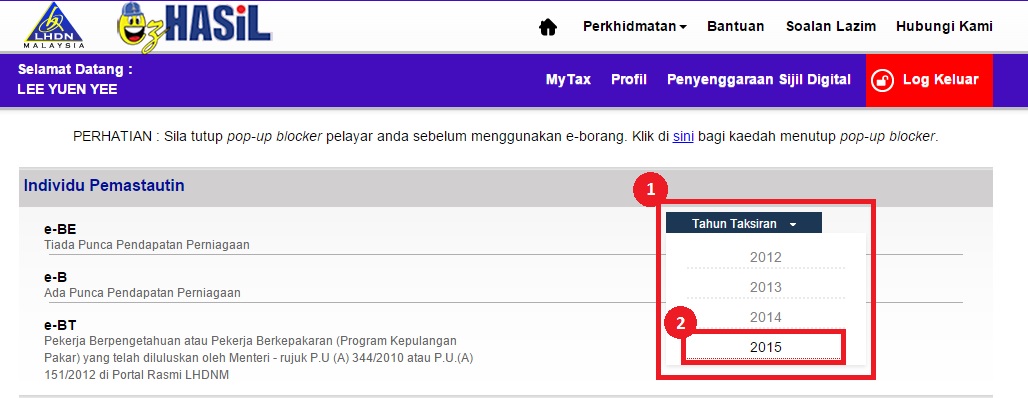

Income tax return form itrf ezhasil e filing is a most convenient way to submit income tax return form itrf. It also saves a lot of time and very easy to complete it online rather than conventional methods by manually filling up the form because all the calculation is automatic. Finally pay your income tax or claim a tax refund for those who do still have outstanding taxes to pay you can do so through many channels in malaysia such as. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing.