Malaysian Income Tax Relief 2018

5 000 limited 3.

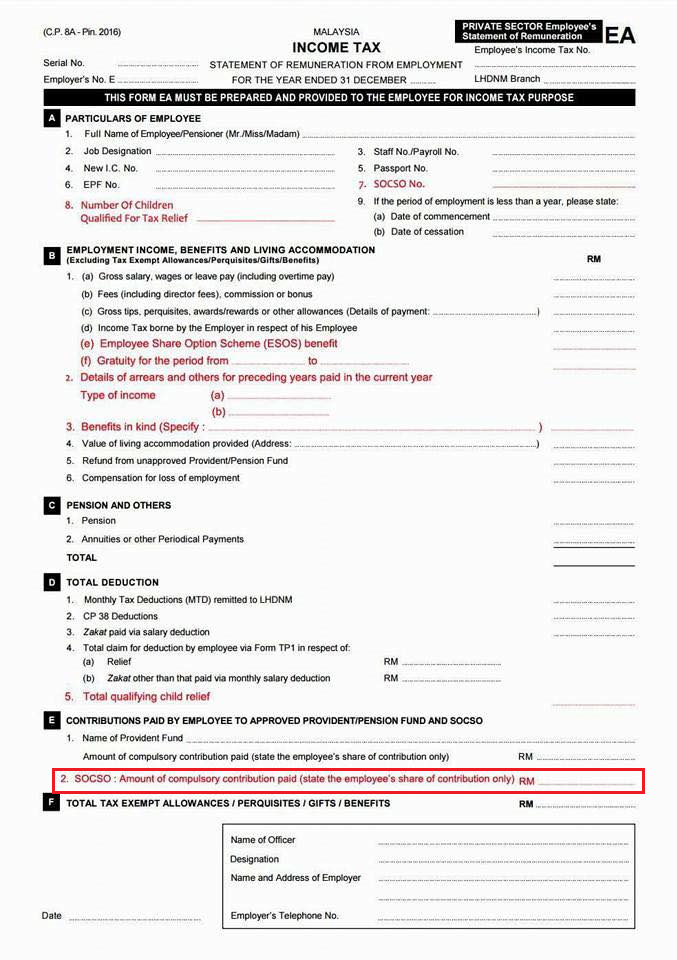

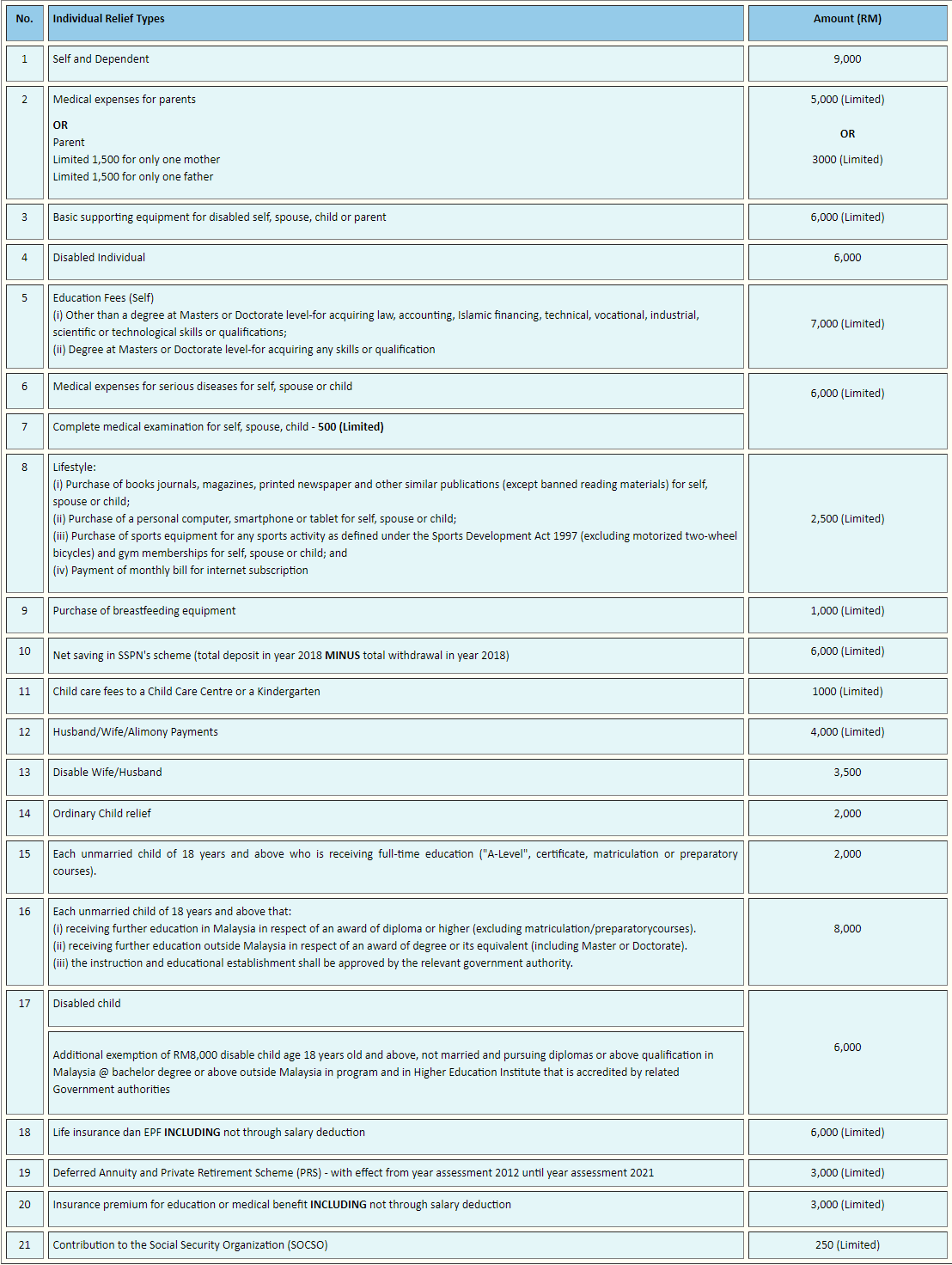

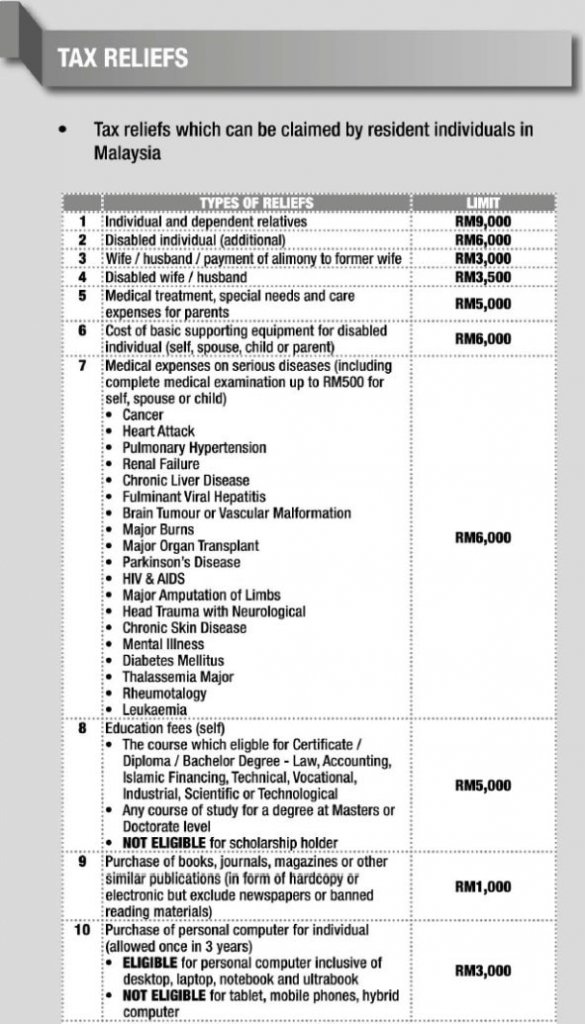

Malaysian income tax relief 2018. Companies are not entitled to reliefs and rebates. If you have deposited money into your sspn account in 2018 then this amount can be claimed in your e be form as well. Child care fees to a child care centre or a kindergarten. Tax reliefs are set by lembaga hasil dalam negeri lhdn where a taxpayer is able to deduct a certain amount for cash expended in that assessment year from the total annual income.

Do you know what is income tax relief. Tax filing season has begun in malaysia and the task of trying to save money through claiming tax relief and rebates can be confusing. This relief is applicable for year assessment 2013 and 2015 only. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from rm1 640 to rm585.

Up to rm 12 000 for couples seeking fertility treatments. There really are a lot of tax reliefs and if you plan your reliefs effectively every year you could be saving thousands in taxes every year. However any amount that is withdrawn after your first deposit in 2018 is not counted. Immediate actions to pay less income tax next year.

However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability. Ringgitplus how to maximize income tax refund 2019. As announced by the prime minister at budget 2018 the m40 incentive consists of a 2 point tax rate reduction which is aimed to help approximately 2 3 million malaysians earning between rm20 001 and rm70 000.

To help make things a little clearer we run through the list of all items eligible for tax relief with explanations for some of the more confusing entries. Imoney income tax relief for ya 2018. Self and dependent special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. That s a difference of rm1 055 in taxes.

Medical expenses for parents. Net saving in sspn s scheme total deposit in year 2018 minus total withdrawal in year 2018 rm6 000. Amount rm 1. On the first 2 500.

Claim the right amount of malaysian income tax relief. These are for certain activities that the government encourages to lighten our financial loads. It should be calculated as the total deposit in the year 2018 minus total withdrawal in the year 2018. Calculations rm rate tax rm 0 5 000.