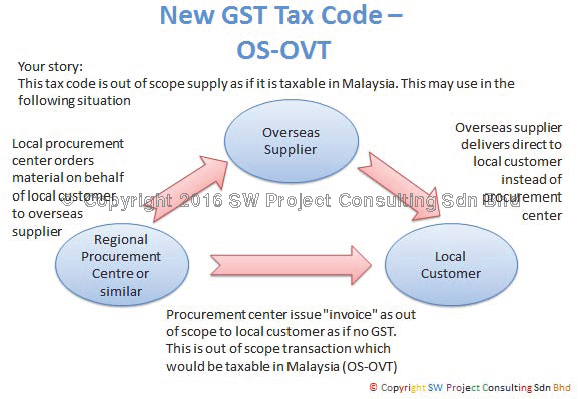

New Gst Tax Code Malaysia 2016

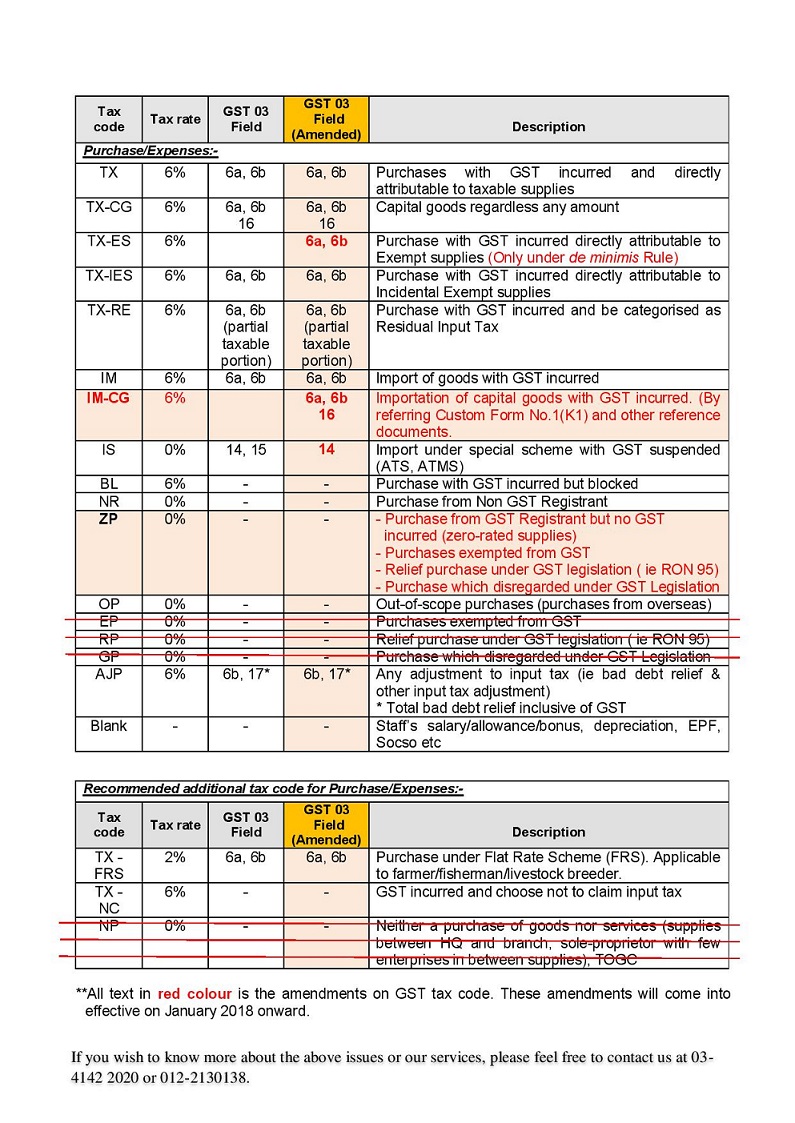

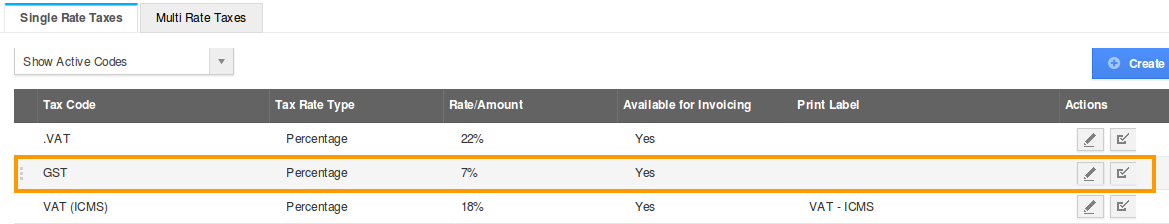

Please refer the following table on the new update made by malaysian customs.

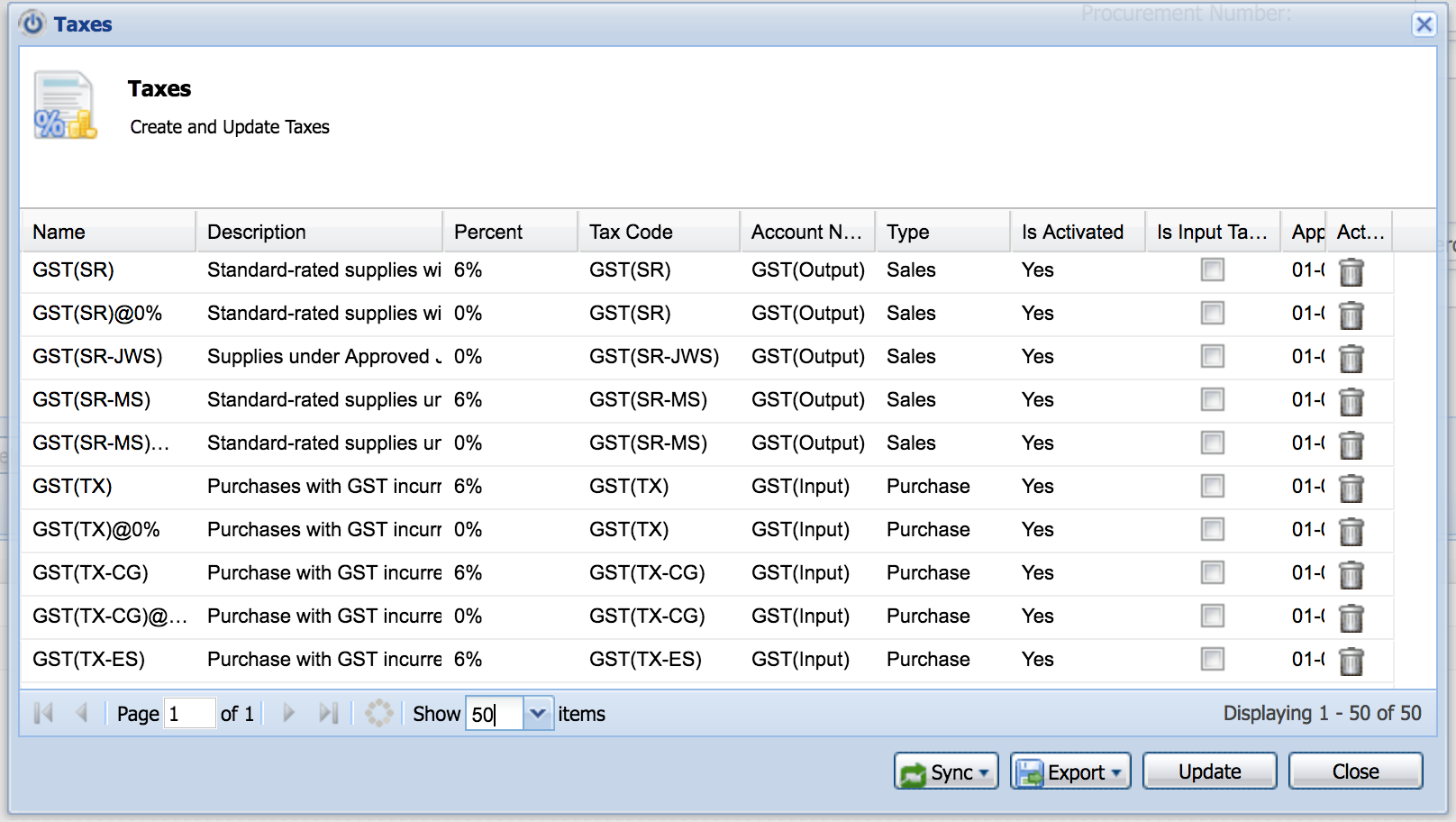

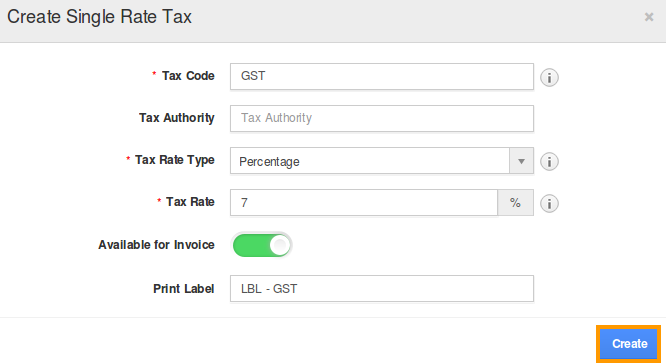

New gst tax code malaysia 2016. Value excluding tax purchase with gst incurred for capital goods acquisition. Import of goods with gst incurred that is not directly attributable to taxable or exempt supplies. While making tax payment through various tax payment options taxpayers have to specify a few information such as name of taxpayer employer income tax number employer number identity number and payment code. Tax codes updated august 2016 tax codes updated august 2016 will be release start from.

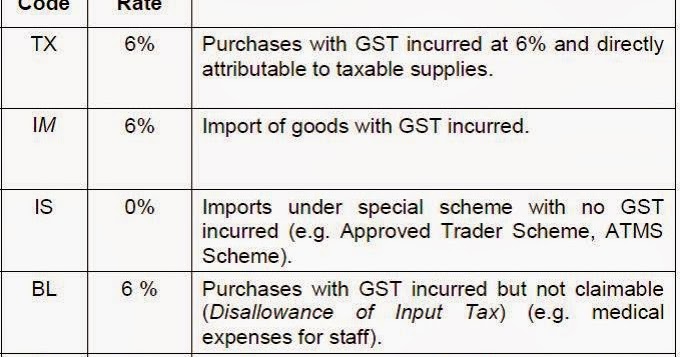

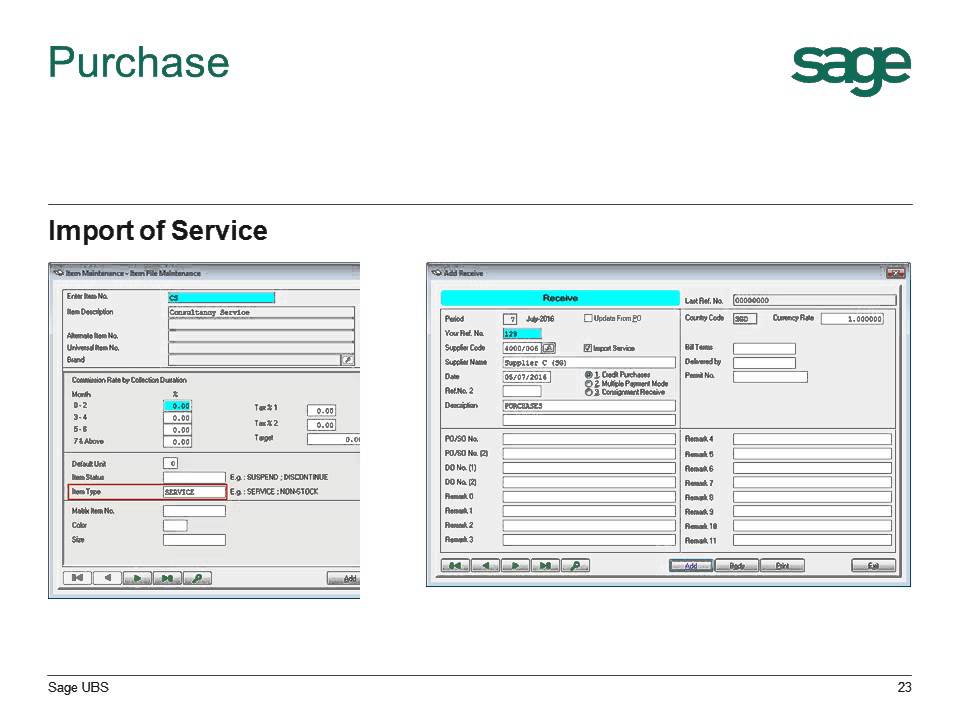

Aesoft technology solutions gst tax code for malaysia aug 18 2016 selangor malaysia kuala lumpur kl supplier suppliers supply supplies aesoft technology solutions is a one stop pos system and related hardware supplier company. Gst code rate description. Apa apa permohonan rayuan cbp. Gst on import of capital goods.

Matters to be treated as neither a purchase of goods nor a purchase of services and no gst incurred. Tax rate 6 gst 03 field. Attention please be informed that this portal will remain active until further notice. Guide on accounting software enhancement towards gst compliance as at 18 july 2016 3 able to comply with the gst legislation.

Medical expenses for staff. Purchases with gst incurred but not claimable disallowance of input tax e g. Field 6a 6b. Therefore the tax invoice must fulfill the prescribed particulars based on gst legislations.

Input tax field 16. Berikutan pemansuhan akta cukai barang dan perkhidmatan 2014 akta 762 yang berkuat kuasa pada 1 september 2018 semua urusan permohonan rayuan cukai barang dan perkhidmatan cbp telah dipindahkan di bawah bidang kuasa tribunal rayuan kastam kementerian kewangan malaysia. 6a 6b and 16. Approved trader scheme atms scheme.

This tax code refers to purchase with gst incurred at 6 for all capital goods acquired that is claimable regardless the value of the goods. Payment code is referring to the type of tax that categorized by inland revenue board irb or lembaga hasil dalam negeri lhdn malaysia. Export of goods from malaysia to designated areas customs form no. Gst on purchases directly attributable to taxable supplies.

For example land and buildings equipment machinery vehicles or others capital goods which the company claims for input tax and capitalize the acquired capital goods as their assets. New tax code as per 01st august 2016 as at 01st august 2016 custom have update few tax code as a new tax code and added new few new tax code. Malaysia gst new tax code update in august 2016. Imports under special scheme with no gst incurred e g.

Gst on import of goods.